New, Tax-Smart Ideas for 2023!

Satisfy Your RMD While Earning a Lifetime of Income

At the end of December 2022, a new Tax Act, The Secure 2.0 Act , was signed into law. Among the many provisions, the law created a terrific opportunity for Jewish National Fund supporters to use their IRAs for a tax-free contribution and receive a lifetime of income from that IRA gift.

Take advantage of the last great tax break and change the world with your IRA! Use your tax-free Charitable IRA Rollover for tax-free gifts to Jewish National Fund.

If you have an IRA, the required age to begin distributions increased to age 73 from 72; you must start withdrawing money from your IRA. These withdrawals are called Required Minimum Distributions (RMD). They have the effect of increasing your taxable income. In many instances, these RMDs can push you into a higher income tax bracket and cause your Social Security payments to become taxable.

Here’s a tax-smart idea that helps!

Instead of taking the RMD from your IRA, tell your IRA provider to send it to Jewish National Fund to support the land and people of Israel. Your gift will not count as income, thereby saving thousands of dollars in higher taxes, and the IRS will still consider that you fulfilled your Required Minimum Distribution obligation.

Your IRA just became a very valuable Charitable Giving Account!! Change the world and save tax dollars.

There are a few rules to follow to qualify your gift for tax-free treatment.:

- You must be 70 ½ years old or older. When you reach the age of 73, you MUST begin withdrawing money according to your age.

- The transfer from your IRA must be paid directly from your IRA to Jewish National Fund. If the distribution comes to you directly, it will be taxable.

- The gift cannot exceed $100,000 in 2023. Married spouses can combine their gifts and can contribute $200,000!

- The contribution from your IRA will not qualify for an additional income tax deduction. But, it also will NOT be counted as income either. That is a better financial outcome for a majority of Jewish National Fund partners.

NEW FOR 2023!

The SECURE 2.0 ACT now allows some IRA Rollovers to earn income from a Charitable Gift Annuity!

One of the constant questions from our IRA donors is whether they can use their IRA money for a Charitable Gift Annuity and earn a lifetime of income. Until this year, the answer has always been no. The new tax law, however, now allows certain rollovers as a contribution for a Jewish National Fund Charitable Gift Annuity.

Some rules that are needed to qualify for this benefit are:

- There is a lifetime limit of $50,000.

- You must complete the $50,000 contribution in one year. You can establish multiple gift annuities, but the total cannot exceed $50,000, and you must complete it in the same calendar year.

- As with other RMD contributions, there is no additional tax deduction

- The income from the gift annuity is fully taxable

- The gift annuity can cover two lives

Your Charitable Rollover can now satisfy two major concerns. Satisfying the IRS rules and receiving significant lifetime income for doing so.

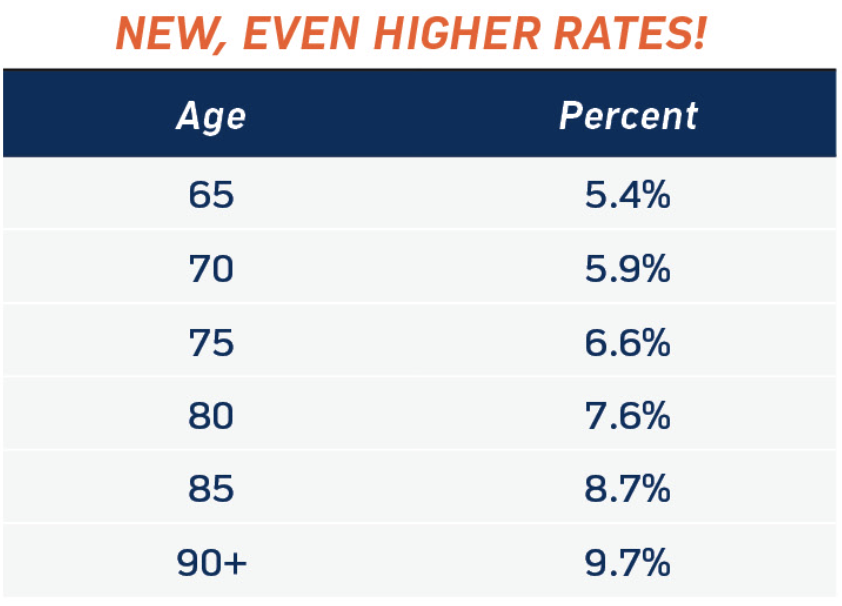

In addition, Jewish National Fund’s Charitable Gift Annuity rates have increased as of January 1, 2023, earning up to 9.7% Annual Income!

Whether rolling over an IRA, or donating appreciated stocks, bonds or mutual funds, consider donating to Jewish National Fund through our Charitable Gift Annuity simple agreement.

Here is a sampling of the single life annuity rates we currently offer*:

*Two life rates will vary

**These rates are subject to change and may not be available in all states

We suggest you check with your advisor about the best ways to take advantage of these tax-saving ideas. For more information on establishing a Charitable Gift Annuity and a personalized complimentary detailed illustration, as well as how your IRA gift can help Jewish National Fund, please call 800.562.7526 or email us at plannedgiving@jnf.org to speak with any of our JNF Planned Giving Specialists.

We look forward to hearing from you.